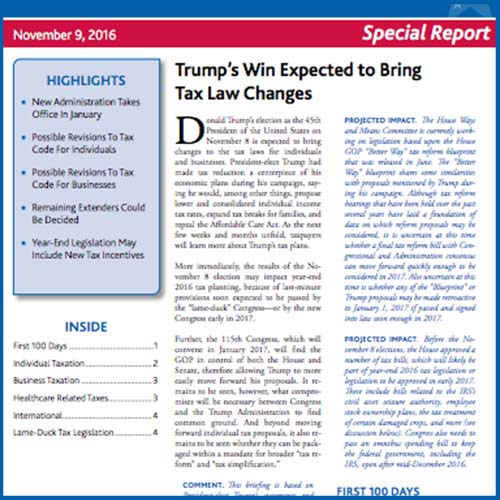

Donald Trump’s election as the 45th President of the United States on November 8 is expected to bring changes to the tax laws for individuals and businesses. President-elect Trump had made tax reduction a centerpiece of his economic plans during his campaign, saying he would, among other things, propose lower and consolidated individual income tax rates, expand tax breaks for families, and repeal the Affordable Care Act. As the next few weeks and months unfold, taxpayers will learn more about Trump’s tax plans.

More immediately, the results of the November 8 election may impact year-end 2016 tax planning, because of last-minute provisions soon expected to be passed by the “lame-duck” Congress–or by the new Congress early in 2017.

Please take a moment to review this Special Report.

Topics of this publication include:

- First 100 Days: What the new administration will bring

- Possible revisions to tax code for individuals

- Possible revisions to the tax code for businesses

- Remaining extenders could be decided

- Year-End legislation may include new tax incentives

As always, please contact your tax professional to discuss questions and concerns you may have.